Umicore has a solid liquidity profile, with spread debt maturities and contained leverage

During its 2025 Capital Markets Day, Umicore presented its financial trajectory for the Group towards 2028, including a detailed overview of its liquidity position and debt and leverage profile.

Liquidity position

At the end of 2024, Umicore’s cash liquidity amounts to €2.0 billion invested short term in term deposits placed with creditworthy financial institutions.

In addition, the Group secured access in 2021 and 2023 to 1.1bn€ of multi-year syndicated revolving credit facilities (undrawn), complemented by short term bilateral revolving credit facilities.

Umicore also has access to Belgian and French commercial paper programs for a total of €1.8 billion (about 0.1bn€ outstanding balance on December 31, 2024). These programs are covered by back-up credit lines.

Debt maturity profile and instruments

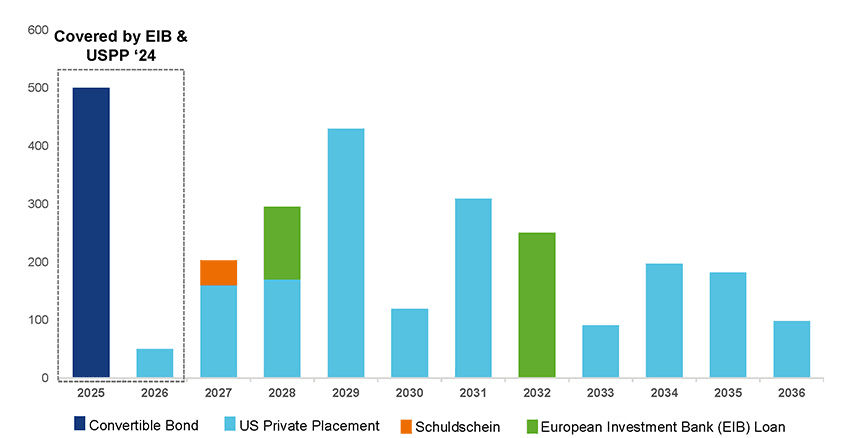

Umicore has a balanced debt maturity profile, with spread redemptions up to 2036 and a weighted average maturity of 4.9 years (end 2024), increasing to 5.7 years excluding the 0.5bn€ Convertible Bond redemption in June 2025.

Sustainable Finance

Umicore has integrated sustainability into its financing strategy. To provide our funding partners with clear and transparent information about our sustainable investment strategy, Umicore has implemented its Sustainability-Linked Financing Framework. This framework supports the issuance of sustainability-linked financial products.

This Sustainability-Linked Financing Framework aligns with the Sustainability-Linked Bond Principles 2023 (SLBP) administered by the International Capital Market Association (ICMA), as well as the Sustainability-Linked Loan Principles (SLLP) established in February 2023 by the APLMA, LMA and the LSTA.

For more, see our Annual Report